🌍 Introduction

As of April 2025, Global Gold Market prices have reached unprecedented levels, with spot gold recently peaking at $3,506 per ounce, marking a 28% increase year-to-date. This increase demonstrates gold’s continued allure as a safe-haven investment in the face of global economic uncertainty.

In times of economic and geopolitical unrest, gold has long been seen as a store of value, a safe haven asset, and an inflation hedge. Due to trade tensions, central bank demand, and macroeconomic uncertainty, gold prices have risen to previously unheard-of levels in 2025. This blog examines the gold market’s current situation, price projections, important demand factors, and possible hazards.

壯陽藥 ha-channel-opacity”/>

📈 Factors Driving the Surge in Gold Prices

1. Economic Uncertainty and Inflation

Investors have turned to gold amid concerns over inflation, geopolitical tensions, and volatile markets. The precious metal has outperformed traditional safe-haven assets like U.S. Treasurys and Bitcoin, solidifying its status as the ultimate refuge for investors.

2. Central Bank Purchases

Central banks worldwide have significantly increased their gold reserves to diversify away from the U.S. dollar. In 2024, central banks added a net 1,044.6 metric tonnes of gold, marking the third consecutive year of purchases exceeding 1,000 metric tonnes. Emerging market central banks, including those of Poland, Turkey, and India, have been particularly active in this trend.

3. Expectations over Interest Rates

Major central banks’ anticipated interest rate cuts have increased the appeal of gold since they lower the opportunity cost of holding non-yielding assets like gold. Citing steadily increasing ETF flows and increased central bank purchases, Goldman Sachs has increased its prediction for the price of gold to $2,900 per ounce for the first part of 2025.

Key Factors Influencing Global Gold Market Prices in 2025

- Trade Wars & Tariffs

- President Trump’s aggressive tariff policies, including a 25% levy on steel and aluminum imports, have fueled economic uncertainty, pushing investors toward gold.

- The U.S.-China trade war has escalated, with tariffs reaching 145% on some goods, increasing inflation risks and gold’s appeal as a hedge.

- Central Bank Demand

- Central banks, particularly China’s PBoC, have been major buyers, adding 5 tonnes in November and 10 tonnes in December 2024.

- Global central bank purchases exceeded 1,000 tonnes for the third consecutive year in 2024, supporting gold’s price floor.

- Inflation & Interest Rates

- U.S. inflation remains at 2.4% (March 2025), above the Fed’s 2% target, keeping real yields low and gold attractive.

- The Fed has held interest rates at 4.5%, but expectations of future cuts could further boost gold prices.

- Geopolitical Risks

- Rising tensions in the Middle East, Russia-Ukraine conflicts, and political instability in the U.S. have increased gold’s safe-haven demand.

🔮 Gold Price Forecasts

Analysts remain bullish on gold’s prospects:

- Goldman Sachs projects gold prices to reach $2,900 per ounce in early 2025, driven by central bank demand and interest rate cuts.

- JP Morgan forecasts that gold prices will surpass $4,000 per ounce by the second quarter of 2026, with an average of $3,675 per ounce by Q4 2025.

- Ed Yardeni anticipates gold could hit $4,000 in 2025 and potentially $5,000 by 2026, driven partly by increased central bank demand to diversify away from the U.S. dollar.

🌐 Regional Impacts

Middle East: Dubai’s Gold Market

The demand for traditional 22-karat gold jewelry has decreased in Dubai’s Gold Souk, despite record gold prices. Buyers are being turned off by high prices and are instead interested in diamonds and lighter gold pieces.

Asia: China’s Strategic Accumulation

The People’s Bank of China has been steadily building up its gold reserves; in January 2025, it added five more tones, bringing its total official holdings to 2,285 tones. Analysts speculate that hidden purchases may have increased China’s real gold holdings.

Europe: Poland’s Aggressive Buying

In 2024, Poland’s central bank increased its gold holdings to 448 metric tones, or 17% of its foreign reserves, by adding 90 metric tones. The National Bank of Poland wants to hold 20% more gold than it currently does.

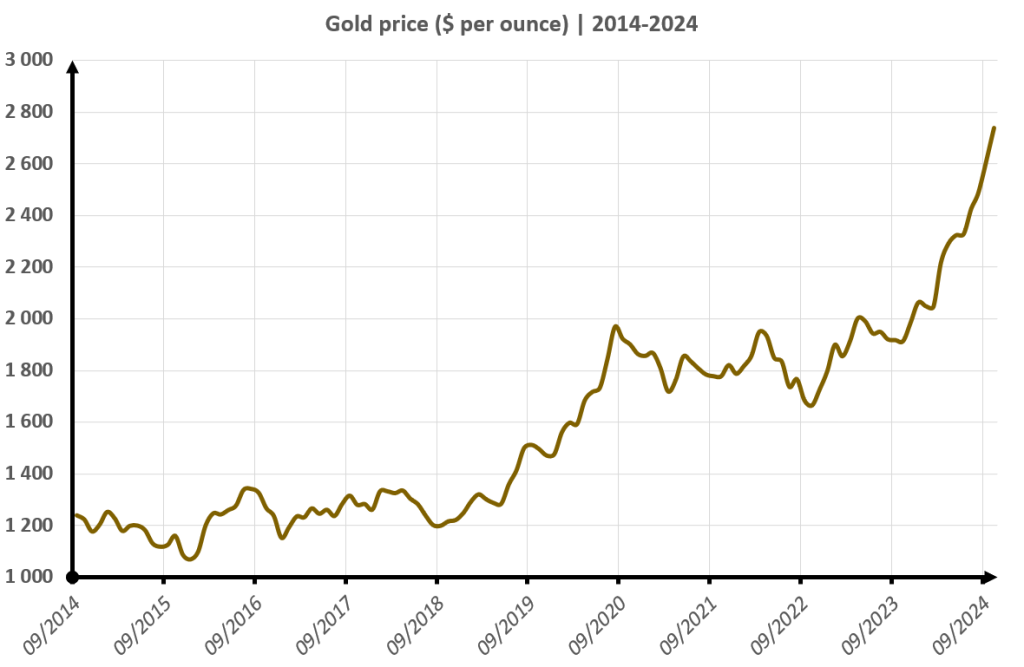

📊 Visualizing Gold’s Performance

To better understand the gold’s trajectory, You should consider the following chart:

🛡️ Gold vs. Other Safe-Haven Assets

In 2025, Global Gold Market has outperformed traditional safe-haven assets:

U.S. Treasurys: Yields have been volatile amid policy uncertainties.

- Bitcoin: Cryptocurrencies have faced regulatory challenges and market volatility.

Gold’s tangible nature and historical stability have reinforced its appeal.

⚠️ Potential Risks and Considerations

Although gold’s outlook is still favorable, investors should be mindful of the following possible risks:

- Policy Shifts: Unexpected modifications to monetary policy may have an effect on the price of gold.

- Economic Recovery: The demand for safe-haven assets may decline if the global economy recovers more quickly than anticipated.

- Central Bank Actions: Prices may be impacted if central bank gold purchases slow down.

🏁 Conclusion about Global Gold Market

Gold’s record-breaking performance in 2025 underscores its role as a hedge against economic uncertainty. With central banks continuing to bolster their reserves and investors seeking safe-haven assets, gold’s upward trajectory appears poised to continue.

Get more Info about Business through Getinfo Club